Effective March 3rd, 2021 the U.S. Small Business Administration (SBA) announced revisions to Loan Amount Calculation and Eligibility allowing individuals who file an IRS Form 1040, Schedule C Profit or Loss from Business, to calculate their maximum loan amount using gross income instead of net profit.

Who Can Apply?

Sole proprietors, Gig workers, Independent Contractors, Self Employed Individuals, Single-member LLC owners (taxed as disregarded entity) who file IRS form 1040 Schedule C and qualify for general PPP eligibility rules.

What if I Already Received a PPP Loan?

Unfortunately, sole proprietors and independent contractors who have already received a PPP loan before March 3rd, 2021 cannot amend the loan application to make up for the difference, but if they qualify, they can receive a Second Draw PPP Loan. (Yes, it is not fair! And this is a developing story)

Choice of 2019 or 2020 Schedule C

Now borrowers will have their choice of using their 2019 or 2020 Schedule C to determine the amount of their First Draw PPP Loan, if not already received, and the Second Draw PPP Loan, which they can qualify.

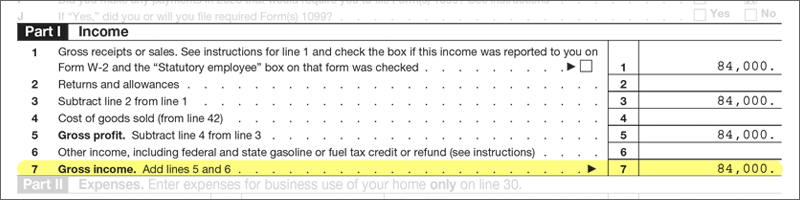

Where Can I Locate Gross Income on Schedule C?

Gross income is the amount reported at line 7 of Schedule C.

How Can I Calculate PPP Loan Amount?

• If a Schedule C filer has NO employees; the borrower may elect simply to calculate its loan amount based on gross income line 7 of Schedule C.

• If a Schedule C filer has employees; the borrower may elect to calculate the owner compensation share of its payroll costs based on either (i) net profit or (ii) gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of IRS Form 1040, Schedule C.

Can I apply for PPP Loan with ITIN?

Yes. Non-citizen small business owners who are lawful U.S. residents can now apply for PPP with Individual Taxpayer Identification Number (ITIN).

Is there any limit?

SBA as to the necessity of a loan will not apply for independent contractors and sole proprietors that report more than $150,000 of gross income on their Schedule C and elect to use gross income to calculate their loan amount. The Interim Final Rule states that:

Borrower with net income exceeding $100,000 should use net income to calculate their First Draw PPP loan amount. Since the maximum loan amount is limited to $20,833 the loan amount would be the same, but the borrower would have the ability to rely on the $2,000,000 safe harbor that applies to the necessity of the loan.

What forms should I file?

New PPP first-draw (Form 2483-C) and Second-draw (Form 2483-SD-C) borrower application forms for Schedule C filers using gross income.

References;

PPP Interim Final Rule – Revisions to Loan Amount Calculation and Eligibility Effective Mar 3, 2021

https://www.sba.gov/document/policy-guidance-ppp-interim-final-rule-revisions-loan-amount-calculation-eligibility

PPP First Draw Borrower Application Form – Schedule C Filers Using Gross Income

https://www.sba.gov/document/sba-form-2483-c-ppp-first-draw-borrower-application-form-schedule-c-filers-using-gross-income

PPP Second Draw Borrower Application Form – Schedule C Filers Using Gross Income

https://www.sba.gov/document/sba-form-2483-sd-c-ppp-second-draw-borrower-application-form-schedule-c-filers-using-gross-income

SBA PPP website

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

Disclaimer

This article is intended for informational purposes and should not be taken as legal or tax advice. You must consult with your tax, financial or legal adviser about your unique financial situation before acting on anything discussed in this article. TaxBasket LLC is providing informational content for general guidance to help small business owners become more aware of certain issues and topics and this article must never be considered as a substitute for advice provided by your tax, financial or legal advisers. TaxBasket LLC or its members cannot be held liable for any use or misuse of this content.