You can find New PPP First-draw application step by step example for filling Form 2483-C with below scenario for a self-employed individual who files an IRS Form 1040, Schedule C Profit or Loss from Business.

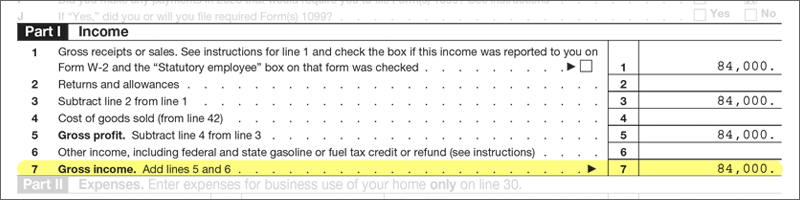

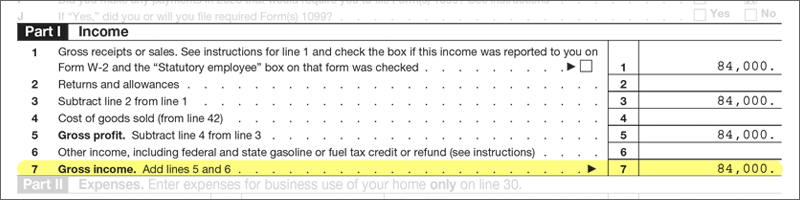

- Gross Income $84,000

- No EIDL Loan

- No employees

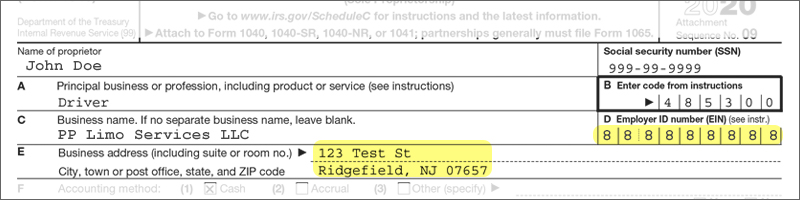

- With DBA or single-member LLC

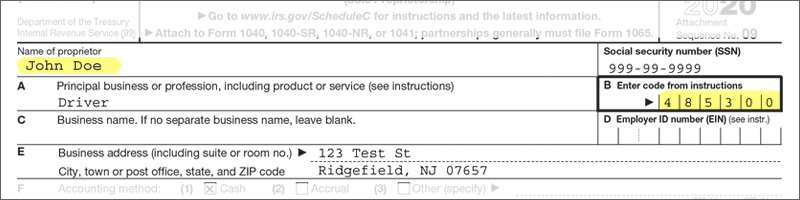

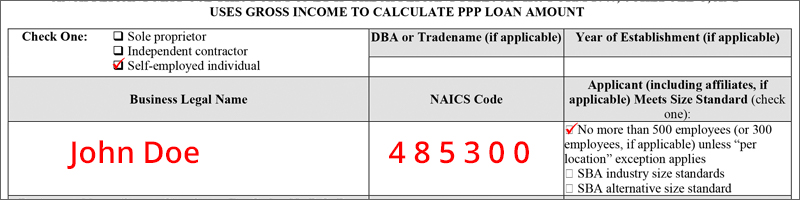

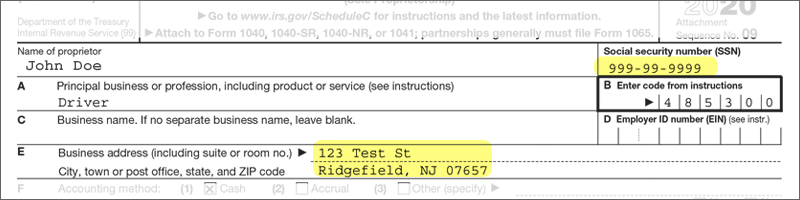

- Without DBA or single-member LLC

- Schedule C is for Tax Year 2020

Enter your name and NAICS Code. If this is a self-employed business without single-member LLC or DBA, you can write “NA” at Year of Establishment field.

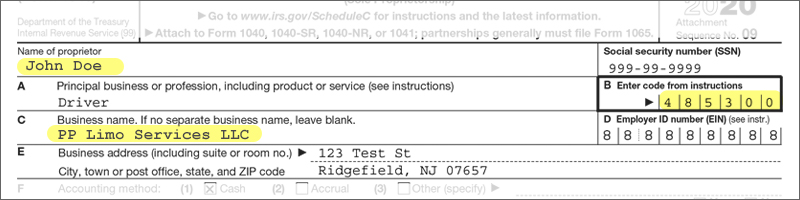

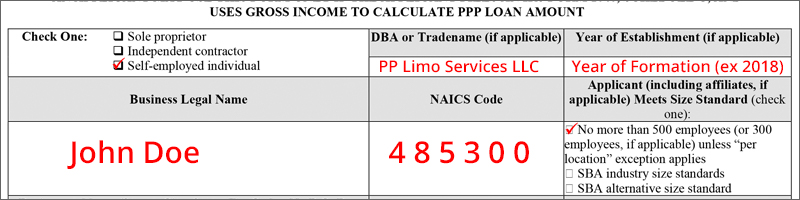

If this business is a single-member LLC or DBA, it should be like this

If this is a self-employed business with single-member LLC or DBA, you will write your DBA or Company name and the year of establishment.

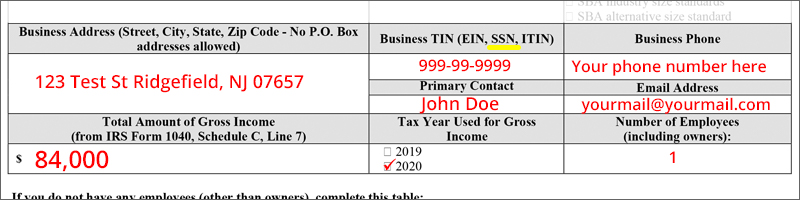

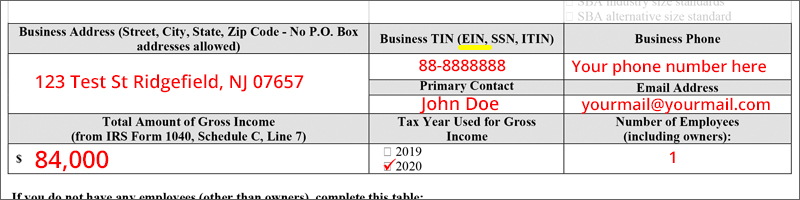

Business address: your business address

TIN: in this case social security number

Business phone: most up to date business phone number

Total Amount of Gross Income: Schedule C line 7

Tax Year: The tax year for which Schedule C you are using

Number of employees: in this case yourself only (1)

If this business is a single-member LLC or DBA, it should be like this

If this is a self-employed business with single-member LLC or DBA, you will write your EIN instead.

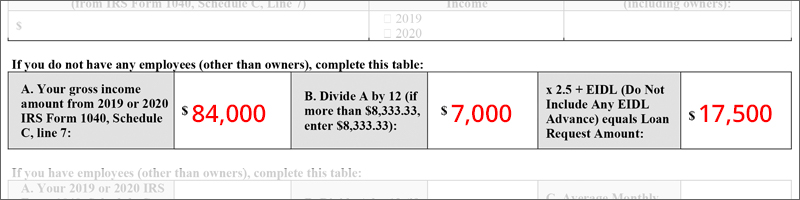

If you do not have any employees (other than owners), you will complete this table, with this scenario, there is no EIDL involved. You can add EIDL if that applies to you.

A. Enter Gross income from Schedule C, line 7

B. Divide A by 12 (if more than $8,333.33,enter $8,333.33)

C. Multiply B by 2.5, this is your qualified PPP loan amount. In this scenario there’s is no EIDL, therefore no EIDL added. If you received EIDL, you can add for your instance. (Do Not Include Any EIDL Advance)

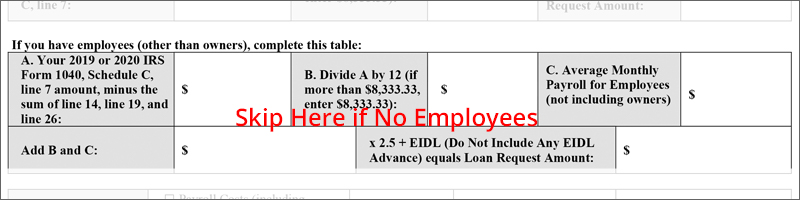

Since there are no employees other than owner, this section will be blank.

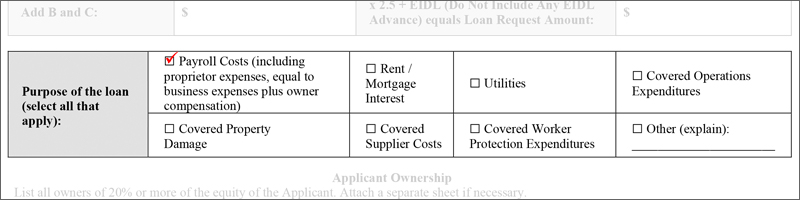

In most cases, this is Payroll costs, for you to pay for yourself as owner compensation.

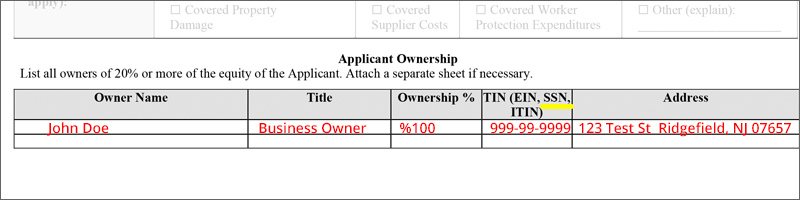

Write owner details in this step such as address, title, SSN or ITIN.

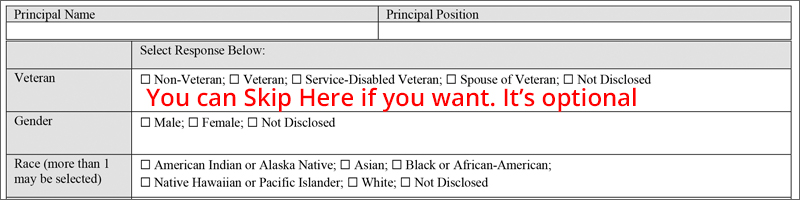

PPP Applicant Demographic Information is optional and will have no bearing on the loan application decision. You can leave this section blank if you want.

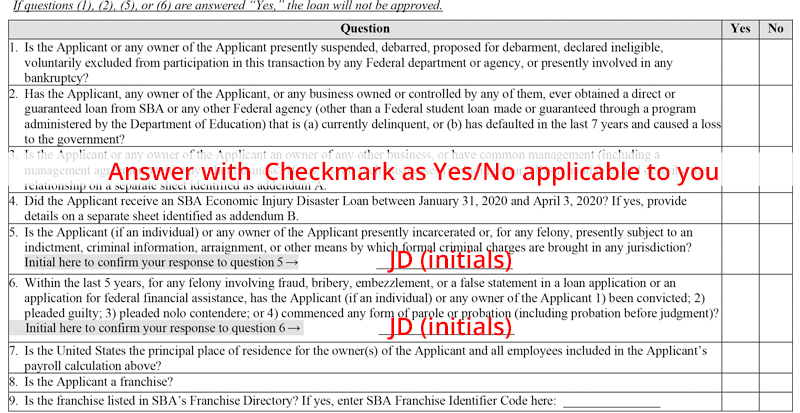

Answer these questions by check marking yes or no and write your initials for question 5 and 6.

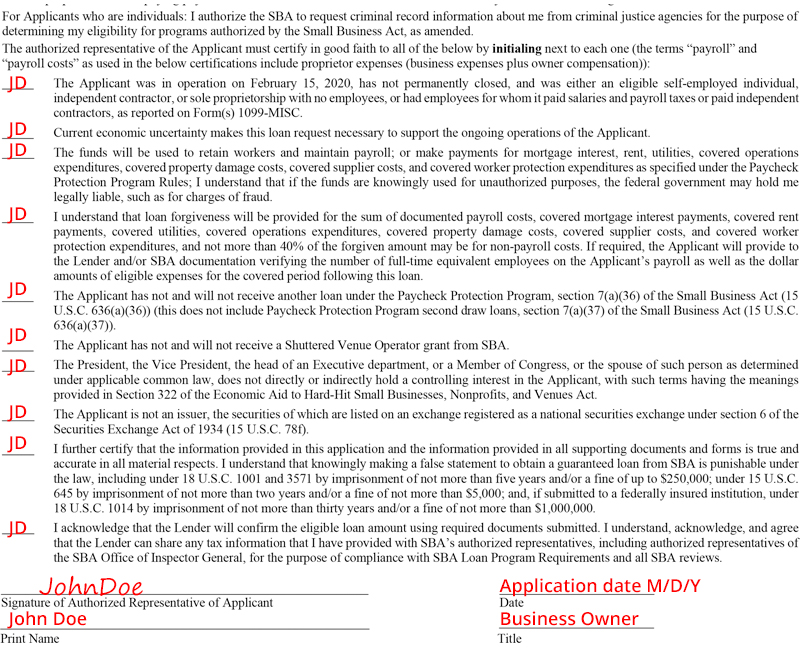

Read this section carefully and certify in good faith to all of the below by initialing next to each one.

References;

PPP Interim Final Rule – Revisions to Loan Amount Calculation and Eligibility Effective Mar 3, 2021

https://www.sba.gov/document/policy-guidance-ppp-interim-final-rule-revisions-loan-amount-calculation-eligibility

PPP First Draw Borrower Application Form – Schedule C Filers Using Gross Income

https://www.sba.gov/document/sba-form-2483-c-ppp-first-draw-borrower-application-form-schedule-c-filers-using-gross-income

SBA PPP website

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

Disclaimer

This article is intended for informational purposes and should not be taken as legal or tax advice. You must consult with your tax, financial or legal adviser about your unique financial situation before acting on anything discussed in this article. TaxBasket LLC is providing informational content for general guidance to help small business owners become more aware of certain issues and topics and this article must never be considered as a substitute for advice provided by your tax, financial or legal advisers. TaxBasket LLC or its members cannot be held liable for any use or misuse of this content.